Investing is a complex process with many options available to the modern investor. To make sense of it all, you need to have a solid foundation in financial basics and an understanding of how the market works. That’s where legendary investor Peter Lynch comes in. In this post, we’ll look at his top 9 books and what you can learn from them. You’re not going to become a master stock picker overnight just by reading these books. But if you’re serious about investing, they will give you a great starting point and help you develop the skills you need to be successful in today’s markets.

Who is Peter Lynch?

When it comes to investing, Peter Lynch is a household name. Lynch’s success as an investor has led to him authoring several books on investing, including “One Up On Wall Street,” “Beating the Street,” and “Learn to Earn.” These titles and his other works offer valuable insights and advice for novice and experienced investors. Peter Lynch’s books offer theoretical knowledge and practical tips and strategies for navigating the stock market.

He was the manager of Fidelity’s Magellan Fund from 1977 to 1990 and achieved an average annual return of 29.2%, making it the best-performing mutual fund during his tenure.

Whether it is his investment strategy of “invest in what you know” or his emphasis on the long-term benefits of patience and discipline, readers of Peter Lynch’s books are sure to gain valuable insights and advice.

Why Should You Listen to Peter Lynch?

There are many reasons why Peter Lynch should be listened to for investment advice.

Open about his successes and failures

In his books, Lynch is candid about the times he made mistakes and the lessons he learned from them. This allows readers to gain insights from his experiences and shows that Lynch is humble and willing to admit when he is wrong. This type of transparency is important in the investment world. Usually, only the successes are highlighted, but it is just as important to talk about the failures to improve and avoid repeating those mistakes in the future. Even with his failures, Lynch has had an incredibly successful career as a fund manager for Fidelity Investments.

Excellent communicator and teacher

Lynch has a knack for breaking down complex investing concepts and explaining them in a clear and accessible manner. He teaches readers how to identify undervalued companies and make profitable investments through his books. He also emphasizes the importance of discipline and patience in investing. When you read Lynch’s books, you not only learn about investing strategies but also gain valuable life lessons. As life-long learner Warren Buffett once said, “I just see Lynch as someone, I learn from all the time.”

A unique approach to investing

Lynch’s “ten bagger” concept, which involves seeking out stocks that have the potential to increase in value tenfold, sets him apart from other investors. His ideas and strategies are original and have proven successful. If we want to become successful investors, it can be beneficial to take advice from someone like Lynch, who has a unique and proven approach.

A down-to-earth attitude

In addition to his unique investment strategies, Lynch also brings a humble and realistic attitude to investing. His books emphasize the importance of extensive research and not being overly confident or cautious in making investment decisions. This down-to-earth approach can be refreshing for individuals new to investing. His readers often praise his ability to make complex financial topics accessible and relatable. Like his investing style, Lynch’s writing is straightforward and to the point.

He has a successful track record

It’s no secret that Peter Lynch has achieved a high net worth. Many authors and professionals consider him an investing legend, as he achieved an average annual return of 29.2% during his 13 years managing the Fidelity Magellan Fund. Like Warren Buffett, he focused on selecting undervalued companies and holding them long-term. When peter lynch explains his investment strategies in his books, it is clear that he has a deep understanding and expertise in the field. Additionally, Lynch’s approach to investing is grounded in practicality and common sense.

Emphasizes the importance of researching and understanding the companies you invest in

One of Lynch’s main principles is investing only in companies you understand and believe in. He encourages thorough research and understanding of a company’s products, management, competitors, and financials before making investment decisions. This strategy can help eliminate unnecessary risks and increase the chances of successful investments. His investment portfolio included well-known companies and smaller, lesser-known businesses that he believed had growth potential.

Do you want to implement Peter Lynch books’ insights to become a successful investor?

Contact Growth Hackers

Top 9 Peter Lynch Books

Now that you have a sense of Lynch’s approach and attitude towards investing, here are the top 9 books written by Peter Lynch.

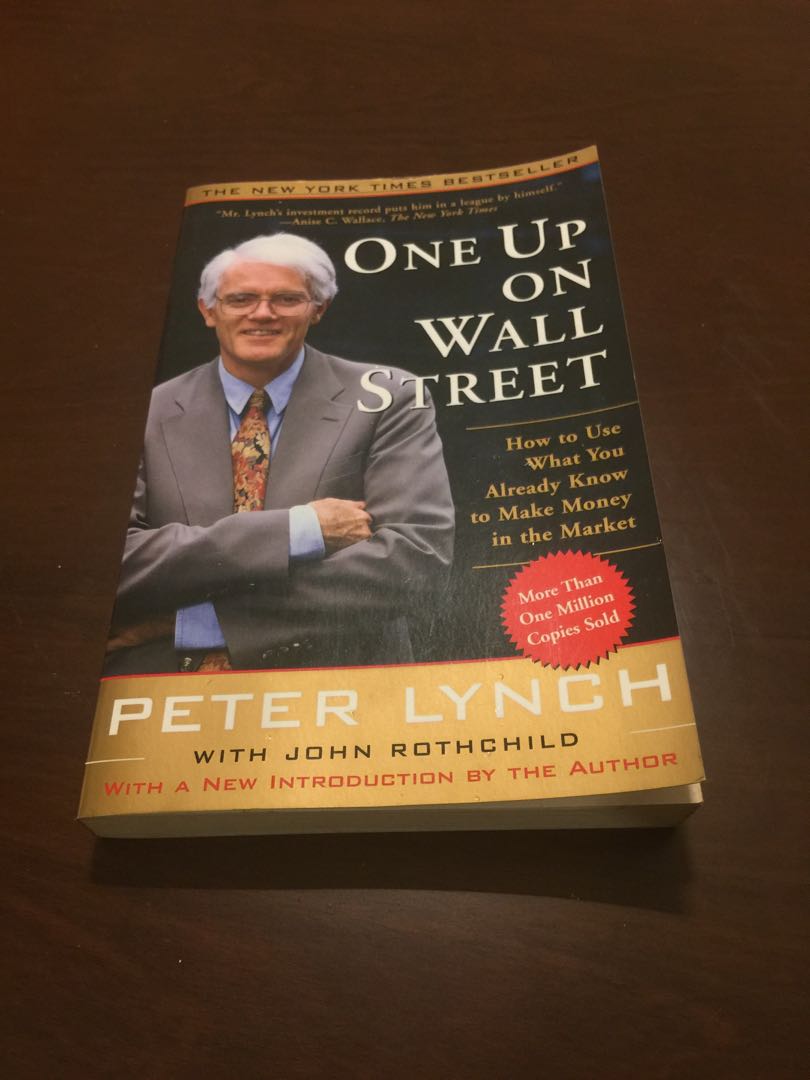

1. One Up on Wall Street

This is a great place to start if you have little to no experience with investing. Lynch provides practical advice for individual investors and emphasizes the importance of understanding the businesses you invest in. He starts with the basics and expands on concepts such as P/E ratios and portfolio diversification. Different wall street professionals may disagree with some of his advice, but overall it is a solid introduction to the investing world. For sound investment advice, Lynch suggests following the “Invest in what you know” strategy, which means investing in industries and companies that are familiar to you.

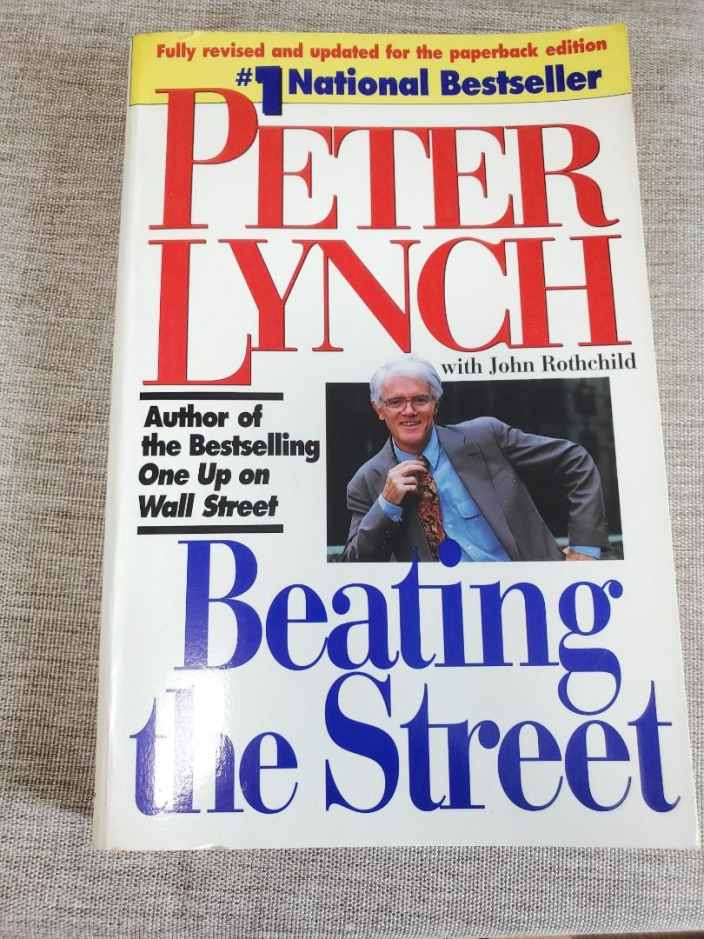

2. Beating the Street

In this book, Lynch shares his investment successes and failures, as well as the experiences of other successful investors. He discusses identifying undervalued stocks and emphasizes the importance of patience in investing. Readers will also learn about different investment styles, such as growth or value investing, and how to choose one that suits their risk tolerance and goals. Plus, Lynch offers tips on evaluating a company’s financial health and avoiding common mistakes, such as chasing after hot stocks or panicking during market downturns.

3. Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business

This book, co-written with John Rothchild, is aimed at beginners looking to learn about investing and business analysis. It offers a practical approach to understanding financial statements and evaluating the health of a company before making investment decisions. Suppose you are considering investing in a restaurant chain. This book might teach you to analyze the company’s revenue growth, expenses, and competition in the industry before making your decision. This peter lynch book is also a great resource for young adults just starting to learn about personal finance and investing.

4. The Church’s Story: A History of Pastoral Care and Vision

Written by his wife, Carolyn Lynch, this book delves into the history of pastoral care within the Christian church. It looks at the evolution of pastoral roles and responsibilities from early Christianity to modern times and examines the changing visions and priorities of churches throughout history. This book offers valuable insights for pastors and church leaders seeking to better understand their role and craft a vision for their congregation.

5. Forbes Great Minds Of Business

Usually published as a special issue of Forbes magazine, this book features interviews and profiles of successful business leaders. In the best peter lynch books, he contributes his insights and reflections on the qualities and characteristics that make for successful investing. This is a valuable resource for any investor looking to learn from the experiences and perspectives of top industry professionals. Here you will find Lynch’s thoughts on management, market trends, and the importance of staying curious and open-minded.

Start implementing Peter Lynch’s strategies in your investing journey today!

6. The Intelligent Investor: The Definitive Book on Value Investing (co-authored with John Rothchild)

Unlike many investing books that focus on quick tips or flashy strategies, this book takes a long-term approach to value investing. It teaches the importance of conducting thorough research and analysis before making investment decisions and how to develop an appropriate level of caution and skepticism when judging a company’s potential for success. This classic text has been updated with insights from Lynch and Rothchild to provide a modern take on value investing principles. It is one of the finest financial literature masterpieces.

7. The Church’s Story: A History Of Pastoral Success And Financial Excellence

In this book, Lynch draws upon his experience as CEO of Fidelity Investments to share insights on how companies and organizations can achieve both spiritual and financial success. He explores how strong values, effective leadership, and sound decision-making can lead to successful outcomes for all stakeholders. This book offers a unique perspective on achieving success in both ministry and business.

8. Corporate Social Investing

While much of the investment world is focused on maximizing returns, Lynch argues for a holistic approach that considers the impact of investments on society and the environment. This book provides practical advice for incorporating social responsibility into investment practices and decision-making. Suppose readers are interested in having a positive impact through their investments. In that case, this book is a valuable resource for incorporating socially responsible investing into the portfolio. Unlike some books on the topic, it also offers insight into how to measure and track the impact of these investments. Plus, it addresses potential trade-offs and challenges in balancing financial returns with social impact. Corporate Social Investing is a valuable addition to any investor’s library.

9. Psychology of Money

In this book, Lynch delves into the psychological aspects of investing and how they can affect decision-making. He provides insight into common biases and emotions that can influence investment choices and tips for avoiding these pitfalls. This book is a must-read for investors looking to improve their decision-making process and better understand their own behavior. Here, Lynch emphasizes the importance of maintaining a long-term perspective and avoiding overreaction to market fluctuations. When it comes to investing, emotions and biases can often lead to poor decisions – but by acknowledging and understanding these tendencies, investors can better manage them and ultimately improve their investment strategy.

Final Words on Peter Lynch Books

With the top seven Peter Lynch books at your disposal, you have everything you need to become a successful investor. From “One Up On Wall Street,” teaching the importance of researching stocks, to “Beating The Street,” showing how to build a diversified portfolio, these books offer invaluable advice from one of the greatest historical investors. It is recommended that readers not only read these books but also take the time to thoroughly understand and implement Lynch’s strategies in their investing journey.

No matter your level of experience, these books will provide valuable insights and techniques to enhance your understanding of the market and maximize your returns. Whether you are an amateur investor or a seasoned professional, these Peter Lynch books are essential for anyone looking to improve their investment strategy and achieve success. Happy investing!

Growth Hackers is a results-driven growth hacking agency helping businesses from all over the world grow. There is no fluff with Growth Hackers. We help entrepreneurs and business owners implement Peter Lynch books’ insights, increase their productivity, generate qualified leads, optimize their conversion rate, gather and analyze data analytics, acquire and retain users and increase sales. We go further than brand awareness and exposure. We make sure that the strategies we implement move the needle so your business grow, strive and succeed. If you too want your business to reach new heights, contact Growth Hackers today so we can discuss about your brand and create a custom growth plan for you. You’re just one click away to skyrocket your business.