Gone are the days when your bank was just a building you visited in person. Thanks to emerging technologies, financial services offer more convenience and options than ever. And they have pretty much taken over the digital space.

This is great news for everyone, especially for Gen Zs who crave on-the-go solutions. Financial institutions are catching up with tech trends and taking leaps toward innovation.

If you’re curious about what’s happening in the world of financial tech, don’t put your curiosity on hold. In this piece, we talk about how groundbreaking technologies are not only revamping services but reshaping entire business models.

Key Points:

- Technologies like blockchain and AI are changing financial services by making them quicker, safer, and easier to use around the world.

- Smart contracts and DeFi are taking over tasks traditionally handled by banks, cutting costs, and making financial transactions automatic.

- FinTech and RegTech are updating the way banks work, making compliance simpler and using cloud computing for flexible and affordable solutions.

- Quantum computing and embedded finance boost data security and bring financial services directly into the apps we use every day for a seamless experience.

- Biometric security makes verifying your identity easier and more secure, reducing the risk of unauthorized access and fraud.

Fintech Revolution: Transforming Traditional Banking

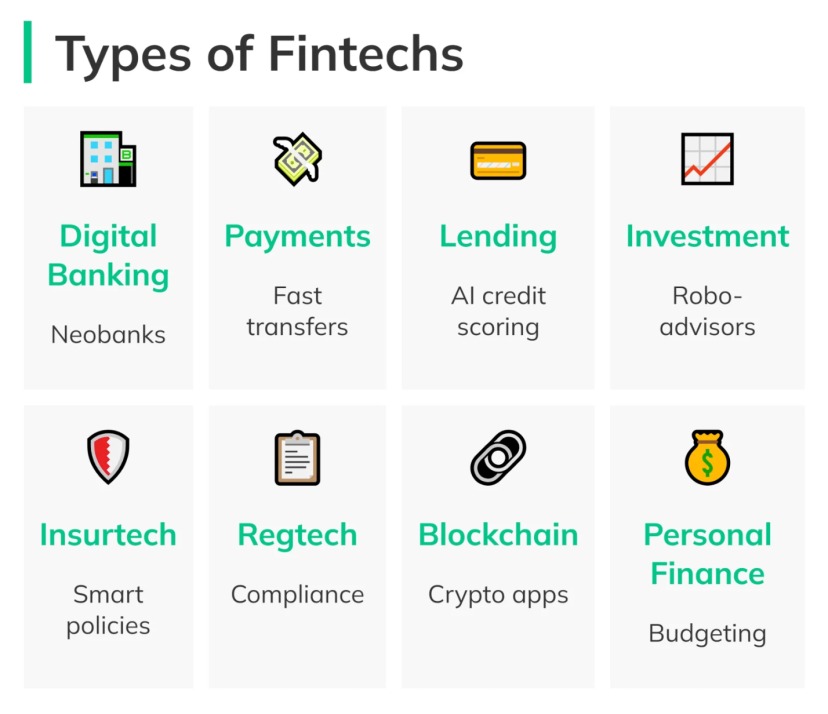

Fintech, short for “financial technology,” is revolutionizing the banking industry. It’s a big hit with millennials and Gen Z banking, who love the speed and ease of digital banking apps.

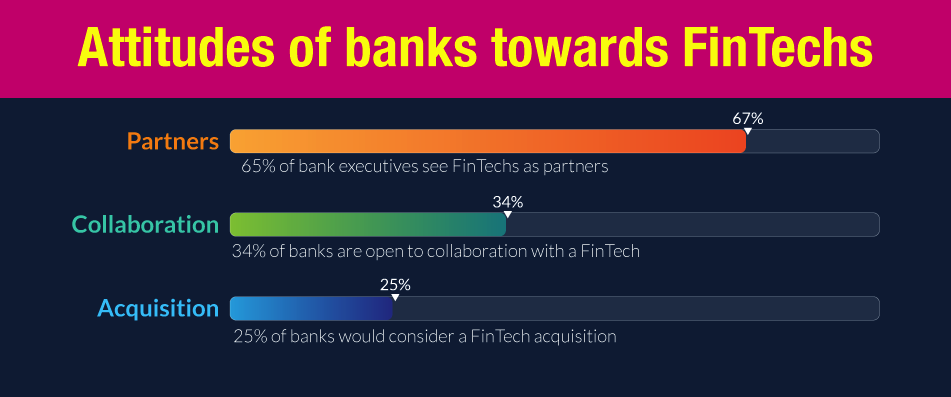

Initially, traditional banks hesitated to embrace these digital changes. However, as the digital wave grew larger, banks had to dive in to keep up. Over time, they realized the perks and began adopting the innovative techniques FinTech brought to the table.

Emerging technologies like artificial intelligence and blockchain have revolutionized financial services, but digital branch banking has been instrumental in ensuring that traditional customer interactions transition seamlessly into digital channels, enabling banks to provide personalized services and improve client satisfaction.

Cloud Computing in FinTech

Cloud computing gives FinTech companies the power of scalable solutions and improved data management. You can easily adjust resources to match demand, ensuring you don’t overspend on unused capacity. The flexibility of cloud services accelerates innovation, allowing you to launch new products without the burden of traditional infrastructure setups.

One major advantage is cost-effectiveness. By using cloud solutions, you cut down on expensive hardware and maintenance costs. Cloud tools enhance data management, making storing, analyzing, and retrieving information more efficient.

However, as you explore cloud computing, pay close attention to security and compliance. Protect your data with encryption and stay updated on regulatory requirements to safeguard your operations.

Ready to harness the power of emerging technologies and lead the future of finance?

Contact Growth Hackers

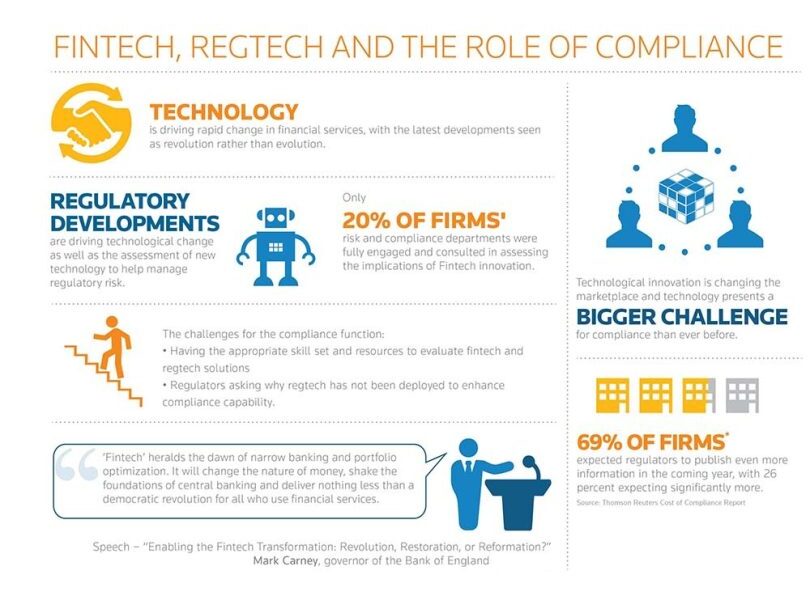

Simplifying Compliance in FinTech with RegTech

RegTech is transforming how FinTech handles compliance, mainly by automating tasks and offering real-time monitoring. This means you can pinpoint compliance issues and manage regulatory data much more accurately. RegTech makes the compliance process more straightforward, allowing you to focus on expanding your reach.

Automating routine tasks helps reduce human error, saving precious time and resources. Real-time alerts keep you informed about any changes in regulations, ensuring you always meet compliance standards.

With RegTech, fintech businesses are not only meeting today’s regulatory needs but also ready to adapt to future changes. This forward-thinking approach simplifies international growth by overcoming cross-border compliance hurdles.

Blockchain: Transforming Trust in Finance

Blockchain serves as a decentralized ledger that securely logs transactions across numerous computers. In traditional settings, trust was built through banks or brokers acting as middlemen. Blockchain changes this by making the data transparent and unchangeable, therefore eliminating the need for intermediaries.

Why is this transformation crucial for financial services? For one, it enhances efficiency by speeding up transaction times dramatically. Remember when international bank transfers used to take days? Thanks to blockchain, these transactions now settle in minutes or even seconds.

Besides speed, the decentralized nature of blockchain adds an extra layer of security, reducing the risk associated with having a single point of failure.

Smart Contracts: Automating the Mundane

Part of the beauty of blockchain is its ability to support smart contracts. These are basically self-executing agreements where the rules are written directly into the code.

Have a payment due upon job completion? A smart contract can handle that for you, automating the process so you don’t have to do a thing—well, except maybe kickstart it.

Smart contracts are great for reducing operational costs and simplifying tasks. They aren’t brewing your morning coffee yet, but they efficiently handle repetitive jobs, leading to lower fees for consumers.

Decentralized Finance: Envisioning the Future

Imagine a world where you can manage your investments, loans, and savings without depending on a traditional bank. That’s where Decentralized Finance, or DeFi, comes in.

Operating on blockchain technology, DeFi uses smart contracts to automate and secure financial transactions. This opens the door to more inclusive financial services and newfound freedom.

Here’s what DeFi offers:

Accessibility | You can access financial services from anywhere with an internet connection. |

Transparency | All transactions are recorded on a public ledger, ensuring clarity. |

Lower cost | Without intermediaries, transaction fees are reduced. |

Immutability | Once recorded, transactions can’t be altered or deleted. |

Security | Cryptographic techniques protect your assets from fraud. |

Artificial Intelligence: The Financial Genius

Artificial Intelligence (AI) uses smart algorithms to analyze data trends and consumer behavior. It’s exceptionally good at predicting and managing risks.

Imagine accurately forecasting stock market swings or assessing credit risks with ease. Companies using AI for these predictive tasks can make well-informed decisions faster than ever before.

Bonus: Can I print checks at home? With AI streamlining financial processes, even traditional tasks like printing checks have become more accessible, enhancing efficiency alongside cutting-edge digital solutions.

The Impact of AI and Machine Learning

By bringing AI and Machine Learning (ML) into the mix, financial institutions can offer more precise and efficient services. For instance:

- AI chatbots: These bots quickly handle customer questions, boosting user satisfaction and saving loads of time.

- Predictive analytics: They study market trends and help in making smarter investment choices.

- Personalized wealth management: Tailoring financial advice to meet individual needs helps maximize financial growth.

When companies roll out AI/ML, it’s crucial to focus on data quality and security to ensure everything works smoothly with existing systems. Also, services should be scalable so they can grow and adapt to future needs.

Robo-Advisors: Smart Guidance Without Human Touch

Robo-advisors are algorithms that give personalized financial advice based on your unique data profile. These advisors reallocate your assets based on real-time data without the emotional biases humans might have. This means you get investment recommendations that fit your needs without any human involvement, saving both time and money.

And here’s where it gets really interesting: Robo-advisors come with machine learning capabilities. They gather insights from past successes and failures, continually refining their financial guidance. They’re intelligent and efficient, embodying the future of personalized financial advice.

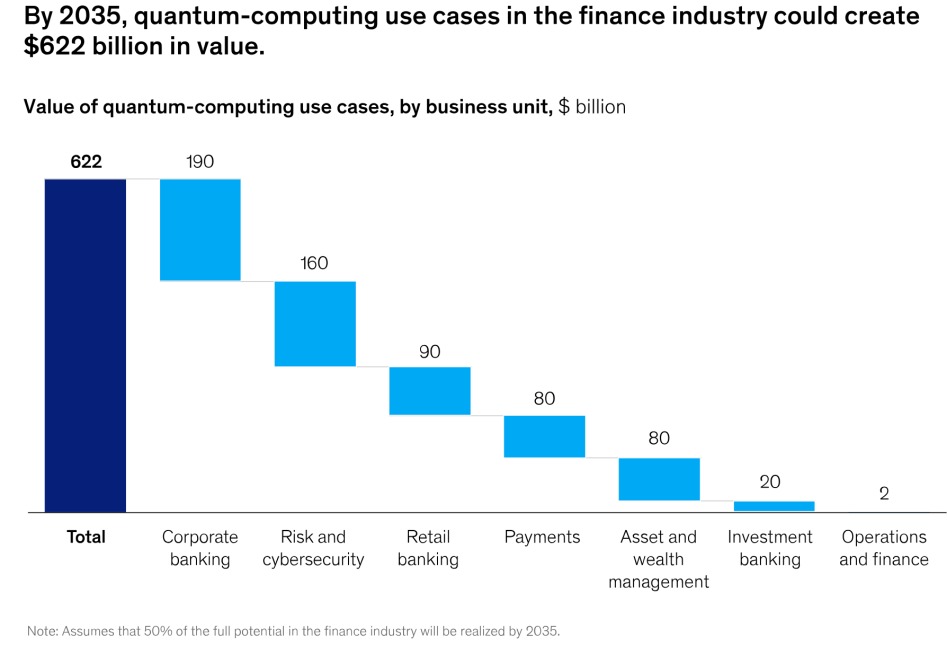

Quantum Computing: A Game Changer in Finance

Quantum computing is set to transform finance with its incredible ability to perform real-time risk assessments and tailor investment portfolios, changing the way financial decisions are made.

This cutting-edge technology can analyze massive datasets at speeds traditional computers can’t match. As a result, you can spot potential risks and opportunities much faster, helping you make more informed and timely decisions.

Picture being able to adjust your investments on the go, making sure they perfectly fit your financial goals and risk preferences.

Quantum computing also plays a vital role in crafting unbreakable quantum cryptography, boosting data security against cyber threats. It’s a powerful tool that promises to bring a new level of efficiency and protection to finance.

Unlock new opportunities in financial services—embrace emerging technologies today!

Introduction to Embedded Finance

Embedded finance is changing the way we manage money by integrating financial services directly into the platforms we use every day.

Now, you can access options like real-time micro-loans or auto-approved lease extensions without ever leaving your favorite apps. This makes managing your finances feel more natural, as you’re able to deal with money matters right where you shop or interact socially.

Imagine booking a vacation online and immediately getting a financing option without needing to visit a bank. Tech giants like Apple and Amazon are at the forefront of this trend, embedding these convenient financial services into their ecosystems.

Advances in Biometric Security

Biometric security improves how we verify identities with seamless technologies like fingerprint and facial recognition. Gone are the days of remembering long and complex passwords or PINs. Instead, you use your unique physical traits—like fingerprints or facial features—to securely access your financial accounts.

This breakthrough in security technology gives you more privacy and control, ensuring that only you can access sensitive information.

By using biometrics, you significantly reduce the risk of unauthorized access and potential fraud. It offers a straightforward yet powerful way to protect your privacy in our increasingly digital world.

Final Words on How Emerging Technologies Are Redefining Financial Services

Emerging technologies are not just making financial services more convenient and efficient; they’re reshaping the financial world altogether. Innovations like blockchain, AI, decentralized finance, and biometric security are making transactions quicker, safer, and easier for people around the globe to access.

As FinTech keeps growing, it offers an exciting opportunity to include more people in financial systems, providing advanced banking solutions to those who previously didn’t have access. This democratization of finance could change wealth management for the better.

But these advancements also bring challenges, especially in areas like security, compliance, and ethical issues. That’s why it’s crucial for financial institutions and tech companies to collaborate closely. Together, they can responsibly leverage these technologies, ensuring they align with regulations and meet consumer expectations.

In this era, adopting digital transformation isn’t just an option; it’s a necessity for the future of finance. By doing so, we pave the way for a more flexible, inclusive, and innovative financial ecosystem.

Growth Hackers is a forward-thinking FinTech marketing firm helping businesses from all over the world grow. There is no fluff with Growth Hackers. We help entrepreneurs and business owners unlock new opportunities with emerging technologies, increase their productivity, generate qualified leads, optimize their conversion rate, gather and analyze data analytics, acquire and retain users and increase sales. We go further than brand awareness and exposure. We make sure that the strategies we implement move the needle so your business grow, strive and succeed. If you too want your business to reach new heights, contact Growth Hackers today so we can discuss about your brand and create a custom growth plan for you. You’re just one click away to skyrocket your business.