Net revenue retention (NRR) is a critical metric for subscription-based businesses. It measures how much revenue a company retains from existing customers over time, accounting for upgrades, downgrades, and cancellations. A high NRR means a business can grow without relying solely on new customer acquisitions.

Tracking net revenue retention helps businesses assess customer loyalty and revenue trends. Unlike simple revenue metrics, NRR highlights whether a company is increasing revenue from its current customer base or losing value due to churn. This makes it a strong indicator of long-term customer success too.

Introduction to Net Revenue Retention

Definition of Net Revenue Retention (NRR)

NRR is the percentage of revenue a business retains from its existing customers over a specific period. It factors in revenue gained from upsells, cross-sells, and price increases while deducting revenue lost from downgrades and customer churn.

A business with an NRR above 100% is growing revenue within its existing customer base. A number below 100% indicates that revenue losses outweigh customer expansions. This metric is particularly important for SaaS and subscription businesses, where recurring revenue determines long-term profitability.

Importance of NRR in SaaS and Subscription-Based Businesses

For SaaS and subscription-based businesses, customer retention is just as important as acquiring new users. A good net retention rate or high NRR shows that customers continue to use the service and are even willing to spend more over time. This leads to sustainable growth without heavy reliance on new customer acquisitions.

Acquiring new customers is expensive. Marketing, sales efforts, and onboarding require significant investment. If a company experiences high churn, it must continuously replace lost customers, making growth difficult. A strong NRR means that even with minimal new customer acquisitions, the business can continue expanding.

Comparison with Other Metrics Like ARR and MRR

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) measure total subscription income over time, but they don’t indicate whether growth comes from existing customers or new sales.

ARR provides a long-term view of revenue, while MRR tracks short-term trends across customer segments. However, neither metric explains how well a company retains and grows revenue from existing customers.

NRR offers deeper insight by showing how much revenue is retained after considering upgrades, downgrades, and churn. A company with a high ARR but low NRR may struggle to maintain long-term stability, while a high NRR signals strong customer loyalty and therefore higher net revenue retention and growth.

What are the Components of NRR

Monthly Recurring Revenue (MRR)

MRR is the total predictable revenue a business earns from its active subscriptions each month. It serves as the foundation for calculating NRR and helps businesses measure financial stability.

A growing MRR indicates a business is adding new customers or increasing revenue from existing ones. A declining MRR suggests problems with customer retention or pricing. Businesses closely track MRR to understand revenue trends and make informed financial decisions.

Expansion MRR: Revenue from Upsells and Cross-Sells

Expansion MRR represents additional revenue earned from existing customers through upsells, cross-sells, or increased usage. This component helps offset revenue lost due to churn or downgrades.

Upsells occur when customers move to higher-tier plans or purchase more advanced features. Cross-sells involve selling complementary products or services alongside the original purchase. Businesses with strong expansion MRR often offer scalable solutions that grow with their customers’ needs.

Contraction MRR: Revenue Lost from Downgrades

Contraction MRR accounts for revenue lost when customers downgrade their subscriptions. This occurs when users switch to a lower-priced plan, remove premium features, or reduce service usage.

A high contraction MRR suggests that customers do not see enough value in premium plans or are experiencing budget constraints. Companies must analyze downgrade patterns to understand why customers are reducing their spending. Addressing these concerns can help minimize revenue loss.

Churn MRR: Revenue Lost Due to Customer Cancellations

Churn MRR measures revenue lost entirely when customers cancel their subscriptions. This is the most damaging type of revenue loss, as it not only reduces MRR but also eliminates future upsell opportunities.

High churn rates indicate dissatisfaction, pricing concerns, or competition from other providers. Businesses must focus on improving customer experience, product value, and engagement to reduce churn and maintain strong NRR.

Want to maximize growth by optimizing your Net Revenue Retention strategy?

Contact Growth Hackers

How to Calculate Net Revenue Retention

NRR Calculation Formula

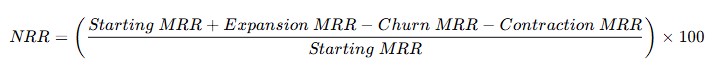

NRR is calculated using the following formula:

This formula accounts for revenue growth from existing customers while subtracting losses from downgrades and cancellations.

Step-by-Step Calculation Process

- Determine the starting MRR at the beginning of the period.

- Add any revenue gained from upsells, cross-sells, or increased usage.

- Subtract revenue lost from downgrades.

- Subtract revenue lost from customer churn.

- Divide the result by the starting MRR and multiply by 100 to get the NRR percentage.

Example Calculation

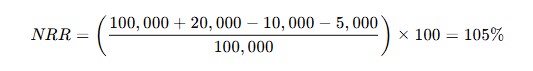

A SaaS company starts the month with $100,000 MRR. It earns $20,000 from upsells, loses $10,000 from revenue churn, and another $5,000 from downgrades.

An NRR of 105% means the company is expanding revenue from its existing customers by 5% after accounting for churn and downgrades.

The Significance of Net Revenue Retention

Role of NRR in Assessing Business Health and Growth Potential

NRR provides a clear picture of how well a company maintains and grows revenue from its existing customer base. A high NRR indicates strong customer retention, account expansion, steady income, and long-term stability.

Investors and business leaders use NRR to evaluate growth potential. A company with an NRR above 100% can expand without relying heavily on new customer acquisitions, making it more financially stable.

Insights Provided by NRR Regarding Customer Loyalty and Satisfaction

NRR directly reflects customer satisfaction. When customers stay and spend more, they likely find value in the service. If they downgrade or cancel, the business may need to improve its offers or customer support.

Tracking NRR over time helps businesses identify trends. A sudden drop could indicate service issues, poor pricing strategies, or increased competition. A steady increase suggests strong customer relationships and effective retention strategies.

Strategies to Improve Net Revenue Retention

Enhancing Customer Experience and Support

Providing excellent customer service increases retention. Quick responses, personalized interactions, and proactive support help customers stay engaged and satisfied.

Offering educational resources, onboarding assistance, and regular check-ins can improve customer experience. Customers who understand and benefit from a service are less likely to leave.

Implementing Effective Upselling and Cross-Selling Techniques

Upselling and cross-selling help increase gross revenue retention and expansion MRR. Businesses should offer relevant upgrades and complementary services that add value to the customer.

Pricing structures should encourage upgrades. Discounts for annual plans, bundled offers, or exclusive features can make higher-tier plans more attractive.

Regularly Analyzing Customer Feedback and Adapting Offerings

Listening to customer feedback helps businesses understand pain points and opportunities for improvement. Regular surveys, support interactions, and user behavior analysis provide valuable insights.

Strengthening Customer Onboarding Processes

A strong onboarding experience helps new customers see value in a product quickly. A confusing or slow start increases the risk of churn.

Clear tutorials, guided walkthroughs, and personalized onboarding support reduce frustration. Customers who understand how to use a product effectively are more likely to stay and upgrade.

Offering Flexible Pricing and Subscription Plans

Rigid pricing structures can lead to customer downgrades or cancellations. Businesses should offer multiple pricing tiers to accommodate different budgets and needs.

Usage-based pricing, add-ons, and customized plans give customers the flexibility to adjust their subscriptions without leaving. This reduces contraction MRR and keeps customers engaged.

Engaging Customers Through Community and Loyalty Programs

Building a customer community strengthens engagement. Discussion forums, exclusive content, and networking opportunities encourage long-term relationships.

Loyalty programs that reward continued use, referrals, or milestone achievements create additional value. Customers who feel connected to a brand are less likely to leave.

Proactively Addressing Customer Churn Risks

Identifying at-risk customers early helps prevent churn. Monitoring usage data and support interactions can highlight warning signs.

Businesses should reach out to disengaged customers with personalized offers, educational content, or special promotions. A proactive retention strategy keeps customers from canceling.

Improving Product Features and Performance

A product that fails to evolve will lose customers. Regular updates, feature enhancements, and performance improvements help maintain user interest.

Businesses should track competitor offerings and industry trends to stay ahead. Customers who see ongoing improvements are more likely to remain loyal.

Strengthening Account Management for High-Value Customers

High-value customers contribute significantly to revenue retention rates. Dedicated account managers can provide personalized support, ensuring long-term satisfaction.

Exclusive perks, priority assistance, and strategic consultations help keep these customers engaged. Retaining a few key clients can have a major impact on NRR.

Reducing Friction in the Renewal Process

Complicated renewal processes cause unnecessary churn. Businesses should simplify subscription renewals, making them seamless and automated.

Clear reminders, easy payment options, and incentives for early renewals keep customers subscribed. A hassle-free renewal experience reduces voluntary churn.

Leveraging Data Analytics for Customer Insights

Data-driven decision-making improves retention strategies. Businesses should analyze customer behavior, feature usage, and purchasing patterns to identify opportunities.

Predictive analytics can help anticipate customer needs. Companies that use data effectively can create personalized offers and interventions that keep customers engaged.

Providing Self-Service Options and Knowledge Bases

Customers appreciate the ability to solve issues on their own. A well-organized knowledge base, FAQs, and troubleshooting guides improve the user experience.

Reducing dependence on customer support for minor issues keeps customers satisfied. A smooth self-service experience enhances retention.

Adapting product features, pricing, and customer support based on feedback can reduce churn and increase expansion revenue. Companies that evolve with customers need to maintain higher NRR.

Enhance your financial success—start improving Net Revenue Retention today!

FAQs on Net Revenue Retention

What is considered a good NRR?

An NRR above 100% is considered good because it means a company is growing revenue from existing customers despite churn and downgrades. SaaS companies often aim for 110% or higher, while enterprise-focused businesses may target 120% or more. A lower NRR indicates the company is losing more revenue than it gains from customer expansions.

What does net retention mean?

“Net of retention” refers to the total revenue a company keeps from existing customers after accounting for upgrades, downgrades, and churn. It provides a clearer picture of customer value over time than net dollar retention does. A strong net retention rate shows that a company can grow without relying only on new customer acquisitions.

What does NRR mean in business?

In business, NRR measures how much recurring revenue a company retains from its existing customers over a given period. It accounts for revenue growth from upsells and cross-sells while the net revenue retention formula subtracts losses from churn and downgrades. A high NRR indicates strong customer retention and business stability.

What is the goal of NRR?

The goal of NRR is to maintain and increase revenue from existing customers while minimizing churn. A high NRR helps businesses grow sustainably without depending solely on new sales. Companies focus on improving customer retention, upselling, and delivering ongoing value to achieve this.

What is an example of NRR?

If a company starts with $100,000 in MRR, gains $20,000 from upsells, loses $10,000 from churn, and another $5,000 from downgrades, its NRR is 105%. This means the company retains and grows revenue from existing customers by 5% after accounting for losses. A positive NRR shows strong customer engagement and financial health.

Should NRR be high or low?

NRR should be as high as possible, ideally above 100%. A high NRR means the company is increasing the revenue generated from its existing customer base, reducing reliance on new acquisitions. A low NRR signals revenue loss and potential retention issues that need immediate attention.

Final Thoughts on What is Net Revenue Retention (NRR) and How to Improve It

Net revenue retention rate is one of the most important metrics for subscription-based businesses. It reveals whether a company is growing through its existing customers or losing revenue over time.

A strong NRR leads to long-term stability and reduced reliance on new customer acquisitions. Businesses that focus on customer experience, effective upselling, and continuous improvement can achieve sustained growth and financial success.

How Growth Hackers Help Improve Net Revenue Retention

Growth Hackers is a leading growth marketing agency that specializes in helping businesses increase net revenue retention through proven growth strategies. We don’t just offer advice—we execute data-driven campaigns, optimize customer engagement, and implement retention-focused marketing that keeps your revenue growing. Our team ensures that your customers stay loyal, upgrade their plans, and continue generating value for your business.

Your competitors are working hard to grow their brands—why not take the lead? With our expertise in growth hacking, we’ll refine your messaging, enhance customer loyalty, and build a strategy that maximizes NRR.

Contact Growth Hackers today to unlock new revenue opportunities and scale your business faster.