There’s no one quite like Warren Buffett, and that includes his reading recommendations. Here are some books that Mr. Buffett has singled out as being worth your time. Whether you’re looking to improve your financial situation or just better understand the world around you, these books are a great place to start.

In this article, we’ll talk about books recommended by Warren Buffett. So pour yourself a coffee, sit down, and get ready to know about Warren Buffett’s recommended books.

Who is Warren Buffett

Warren Edward Buffett is an American business magnate, investor, and philanthropist who serves as the chairman and CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth of over US$97.7 billion in 2022.

Throughout his career, he has amassed a massive fortune, and today he is considered one of the richest men in the world. Buffett is known for his patient, disciplined investment style and ability to spot undervalued companies. He is also well-known for his philanthropy and has pledged to give away much of his fortune to charitable causes.

In addition to his business acumen and philanthropic work, Warren Buffett is also known for his down-to-earth personality. He is often quoted as saying that he feels “lucky” to have been born in America and is a strong advocate for the free market system. As one of the world’s most respected people in business, Warren Buffett continues to set the standard for success.

His story is an inspirational example of what can be accomplished through hard work and determination. He has also recommended several books over the years that he believes can help people to improve their lives.

Books Recommended by Warren Buffett

Warren Buffett is a voracious reader, and he has recommended several books over the years that he believes can help people to improve their lives. Here you will know about almost every book Warren Buffett has recommended.

1. “How to Win Friends & Influence People” by Dale Carnegie

Originally Published: 1936

Dale Carnegie’s book “How to Win Friends and Influence People” is a classic self-help book. The book has sold over 15 million copies and translated into 37 languages. Despite its age, the book’s lessons are still relevant today. Warren Buffet has credited the book with helping him to become a successful investor. In a recent interview, Buffett said, “You will not see the degree I received from the University of Nebraska in my office. You won’t find out about the master’s degree from Columbia University. However, you will notice the award certificate from the Dale Carnegie Course.” Carnegie’s book contains essential advice on how to build relationships, communicate effectively, and resolve conflict. While some of the book’s recommendations may seem dated, its core message is as relevant as ever. For anyone looking to improve their social skills, “How to Win Friends and Influence People” is well worth a read.

2. “Showing Up for Life: Thoughts on the Gifts of a Lifetime” by Bill Gates Sr. and Mary Ann Mackin

Originally Published: 2010

In his annual letter to shareholders, Warren Buffett recommended the book “Showing Up for Life: Thoughts on the Gifts of a Lifetime” by Bill Gates and Mary Ann Mackin. Warren Buffett recommends this book, and it’s easy to see why. The book is full of stories and advice about how to live a joyful and fulfilling life, no matter what challenges come your way. Gates Sr. and Mackin emphasize the importance of showing up for yourself and others, even when it’s difficult. They also remind readers that everyone has something special to offer the world. With its uplifting message and practical advice, Showing Up for Life is a book that will stay with you long after you’ve finished reading it.

3. “The Warren Buffett CEO: Secrets from the Berkshire Hathaway Managers” by Robert P. Miles

Originally Published: 2002

The Warren Buffett CEO is a collection of interviews with managers from Berkshire Hathaway, the conglomerate Buffett himself chairs. These managers offer an inside look at how they have created such a successful company, and their advice is as varied as their backgrounds. However, they all share one common trait: a commitment to doing what is best for their shareholders. This book is essential for anyone who wants to learn more about business strategy and how to build a successful company.

Want to gain new knowledge and perspective from the books recommended by Warren Buffett?

Contact Growth Hackers

4. “The Intelligent Investor” by Benjamin Graham and Jason Zweig

Originally Published: 1949

In The Intelligent Investor, Benjamin Graham and Jason Zweig offer readers a sound framework for thinking about stock investing. Building on Graham’s original work, Zweig provides clear explanations of key concepts, alongside real-world examples and insights from Warren Buffett. The book is divided into three sections: “The Investor and His Demons,” “The Principles of Security Analysis,” and “Portfolio Policy for the Stockholder.” Each section includes several chapters discussing different aspects of stock investing in detail. While some of the concepts may be challenging for beginners, The Intelligent Investor is worth reading for anyone who wants to understand how to build a successful portfolio.

5. “The Little Book of Common-Sense Investing” by John C. Bogle

Originally Published: 2007

The book “The Little Book of Common-Sense Investing” by John C. Bogle is a great read for anyone interested in investing. The book is about the broad stock market Index and how it can help you succeed in investing. The book offers a straightforward approach to investing that is easy to understand and follow. One of the key concepts that Bogle discusses is the importance of diversification. He argues that investors should not put all their eggs in one basket but should spread their investments across various asset classes. This will help protect against losses in any particular asset class and provide a steadier return over time. Warren Buffett has praised Bogle’s book, calling it “a road map for investors.” Whether you are just starting or have been investing for many years, “The Little Book of Common-Sense Investing” is definitely worth a read.

6. “A Few Lessons for Investors and Managers From Warren Buffett” by Peter Bevelin and Warren Buffett

Originally Published: 2012

A Few Lessons for Investors and Managers from Warren Buffett is a book every investor should read. Management is good but leadership is better. You want managers to become leaders. This book offers a concise and insightful look into the mind of one of the world’s most successful investors. Bevelin draws on Buffett’s letters, speeches, and interviews to provide readers with a clear understanding of his investment philosophy. The book covers a wide range of topics, including risk management, what is a good and bad business, acquisitions and their traps, yardsticks, compensation issues, business valuation, risk reduction, corporate governance, value investing, and shareholder communication. Perhaps most importantly, it gives readers a clearer understanding of how Buffett thinks about and approaches investing.

7. “Warren Buffett’s Ground Rules” by Jeremy Miller

Originally Published: 2016

In his letter to shareholders, Buffett singed Miller’s “Warren Buffett’s Ground Rules” as a must-read for anyone looking to improve their investment strategy. In the book, Miller compiles a list of the investing principles that Buffett has followed throughout his career. These principles are based on Buffett’s experiences and philosophies, providing insights into how he approaches the markets. For example, one of Buffett’s ground rules is to “Think for yourself.” This means that investors should do their own research and not blindly follow the advice of others. By following this advice, investors can better understand the companies they’re investing in and make more informed decisions. Another one of Buffett’s ground rules is to “Be patient.” Investors should be patient when waiting for the right investment opportunities. Investors can avoid making bad decisions that lose them money by being patient and holding out for good investments.

8. “Business Adventures: Twelve Classic Tales from the World of Wall Street” by John Brooks

Originally Published: 1969

One of Warren Buffett book recommendations is the “business Adventures: Twelve Classic Tales from the World of Wall Street” by John Brooks. This is one of the top business strategy books of all time. The book contains case studies on some of the time’s biggest business scandals and failures. While the book may be over 50 years old, its lessons are just as relevant today. For Buffett, the book is a reminder that even the most well-respected businesses and leaders can make mistakes. As he puts it, “You only find out who is swimming naked when the tide goes out.” “Business Adventures” is a must-read for anyone looking to better understand the business world.

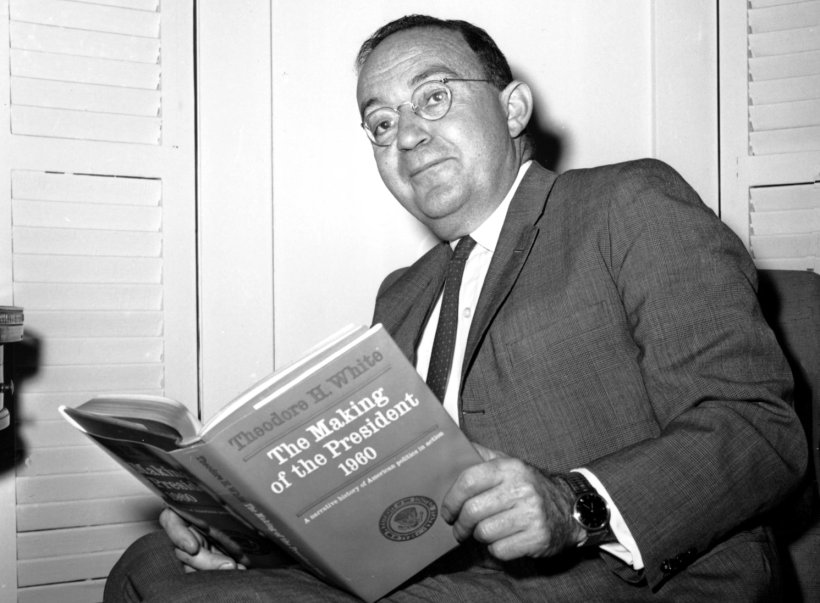

9. “The Making of the President 1960” by Theodore H. White

Originally Published: 1961

In the Making of the President 1960, Theodore H. White chronicled then-Senator John F. Kennedy’s successful presidential campaign. Warren Buffett has called the book “one of the most influential books ever written about American politics.” He praised White’s insights into the nation’s presidential election process, calling it “an extraordinary work of reporting and analysis.” Buffett also noted that the book remains relevant today, despite being nearly 60 years old. “The Making of the President 1960 is as timely today as it was when first published,” he said. “If you want to understand how presidential campaigns are won and lost, this is the book to read.”

10. “The Most Important Thing” by Howard Marks

Originally Published: 2011

Howard Marks is the founder of Oaktree Capital Management, and his book “The Most Important Thing” is a favorite of Warren Buffett. In the book, Marks shares his insights on investing and risk management. He argues that successful investing requires a clear understanding of risk and an ability to stay calm when others are panicking. Marks also emphasizes the importance of diversification, value investing, and patience. While “The Most Important Thing” is not a how-to guide, it provides valuable insights from which any investor can benefit. If you’re looking for a book that will teach you how to become a billionaire like Warren Buffett, this isn’t it. But if you want to learn more about sound investment principles, “The Most Important Thing” is well worth your time.

11. “Limping on Water” by Philip Beuth and K.C. Schulberg

Originally Published: 2015

The book “Limping on Water” by Philip Beuth and K.C. Schulberg. Buffett praised the book for its clear and concise explanation of the value investing philosophy. He said it would be a valuable resource for experienced investors and those just starting out. “Limping on Water” is a clear and well-written guide to value investing, and it provides readers with a practical framework for identifying undervalued companies. Further, the authors draw on their years of experience in the investing world to offer insights and advice on avoiding common pitfalls. In this book, the author explains his leaders, Tom Murphy and Dan Burke, and how they manage to create value. “Limping on Water” is an essential read for anyone who wants to learn more about value investing, and it is sure to become a classic in the field.

Get ready to apply the insights from these books to benefit yourself and your business!

12. “Common Stocks and Uncommon Profits and Other Writings” by Philip A. Fisher

Originally Published: 1957

The “Common Stocks and Uncommon Profits” is considered one of the most influential investing books. The book is a collection of 15 essays written by value investor Philip Fisher. Philip pioneered many of the commonly used principles by investors, including the importance of conducting thorough research and taking a long-term view. Fisher stresses the need to find companies with strong fundamentals and management teams committed to creating shareholder value in his writing. He also advocates for looking beyond traditional financial measures when making investment decisions. Warren Buffett has called Fisher’s book “one of the most influential books on intelligent investment commitments ever written” and recommends it to all investors, regardless of experience level.

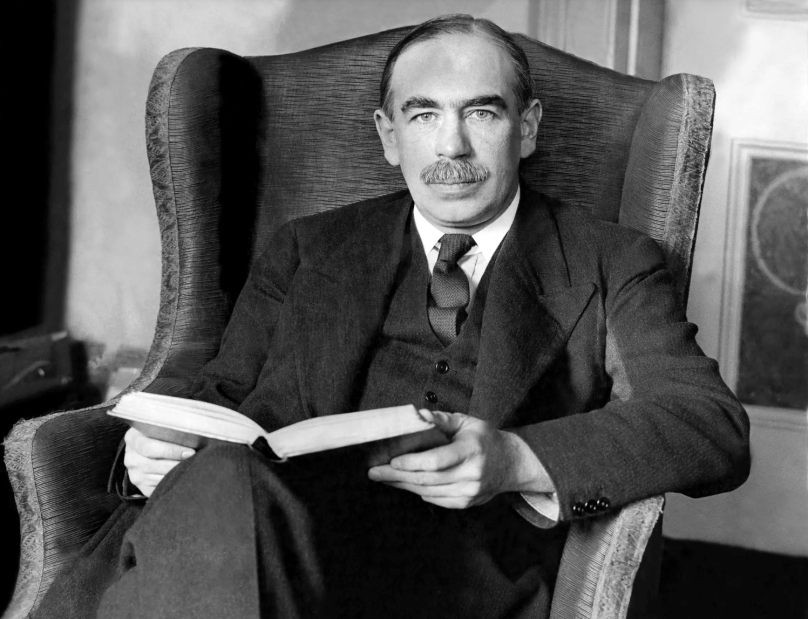

13. “Essays in Persuasion” by John Maynard Keynes

Originally Published: 1931

While most people are familiar with the work of John Maynard Keynes as an economist, fewer are aware of his skills as a writer and thinker. Essays in Persuasion is a collection of his writings on economics and politics, and it offers a fascinating glimpse into his thinking on a wide range of topics. Warren Buffett has called it one of his favorite books, and it’s easy to see why. Keynes is a masterful thinker; his essays are both highly enjoyable to read and deeply insightful. Essays in Persuasion is an essential read if you’re looking for an introduction to Keynes’s thoughts or want to explore some of the greatest essays.

14. “One Thousand Ways to Make $1000” by F.C. Minaker

Originally Published: 1936

Many people think that you need to have a lot of money to make money. However, this is not always the case. There are plenty of opportunities out there for people who are willing to work hard and be creative. One person who knows this well is Warren Buffett. He recommended a book called “One Thousand Ways to Make $1000” by F.C. Minaker. The book provides a detailed list of opportunities for making money, from starting a business to investing in stocks. While some of the ideas may require more capital, the book is a great resource for anyone looking for ways to make money. With a little effort and creativity, anyone can find opportunities to make a profit.

15. “Poor Charlie’s Almanack” by Charles T. Munger

Originally Published: 2005

In “Poor Charlie’s Almanack,” Charles T. Munger provides readers with a wealth of wisdom on various topics, from investments and business to psychology and philosophy. Warren Buffett said, “No book has influenced my thinking more than Poor Charlie’s Almanack.” This is not surprising, given Munger’s clear thinking and intelligent insights. The book is crammed with nuggets of wisdom that will benefit any reader, regardless of background or experience.

Summary of Books Recommended by Warren Buffett

Warren Buffett is one of the most successful investors in history, and he has a lot of wisdom to share regarding money and business. If you’re looking for good financial advice or want to learn more about business and investing, we’ve collected all of Warren Buffett’s book recommendations in one place, so you can start your reading list today.

Growth Hackers is an award-winning Shopify SEO agency helping businesses from all over the world grow. There is no fluff with Growth Hackers. We help entrepreneurs and business owners apply the insights from the books recommended by Warren Buffett, increase their productivity, generate qualified leads, optimize their conversion rate, gather and analyze data analytics, acquire and retain users and increase sales. We go further than brand awareness and exposure. We make sure that the strategies we implement move the needle so your business grow, strive and succeed. If you too want your business to reach new heights, contact Growth Hackers today so we can discuss about your brand and create a custom growth plan for you. You’re just one click away to skyrocket your business.