Grow your business and keep costly misclassification lawsuits at bay

For any startup, being able to hire is exciting. It means things are going well enough that additional help is required. But it’s also easy to get carried away in the excitement and lose focus on what matters, especially when you need to scale up fast. SO, how you should hire when you're scaling up?

According to a Startup Genome report, 74 percent of high-growth internet startups fail due to premature scaling. Growth, specifically headcount, costs money and that money is needed in advance before you can see the return on investment.

Added to the mix is how the gig economy is changing the way businesses hire. An Intuit study found that freelancers have doubled in the workforce in the past 25 years, and is expected to make up almost half of the workforce by 2030. At first glance, employers are viewed as the big winners of this equation. The availability of freelancers allows employers to hire as needed, without committing all the resources that come with full-time employees.

But the bevy of employee misclassification lawsuits playing out nationwide in recent years and the hefty penalties ranging from $4.6 million to $27 million and $169 million meted out to Instacart, Lyft, and Uber for employee misclassification has companies rethinking their hiring strategies. So before you let that new hire sign on the dotted line, here’s what you should consider, to make sure that they are classified correctly from the get-go.

According to a Startup Genome report, 74 percent of high-growth internet startups fail due to premature scaling. Growth, specifically headcount, costs money and that money is needed in advance before you can see the return on investment.

Added to the mix is how the gig economy is changing the way businesses hire. An Intuit study found that freelancers have doubled in the workforce in the past 25 years, and is expected to make up almost half of the workforce by 2030. At first glance, employers are viewed as the big winners of this equation. The availability of freelancers allows employers to hire as needed, without committing all the resources that come with full-time employees.

But the bevy of employee misclassification lawsuits playing out nationwide in recent years and the hefty penalties ranging from $4.6 million to $27 million and $169 million meted out to Instacart, Lyft, and Uber for employee misclassification has companies rethinking their hiring strategies. So before you let that new hire sign on the dotted line, here’s what you should consider, to make sure that they are classified correctly from the get-go.

Understand your business needs

Headcount is inevitable to scale your business. Employee classification is where many employers run afoul of the law, but how do businesses decide between investing in a full-time workforce and engaging independent contractors?

According to Maria O. Hart, an attorney specializing in employment law and business litigation, the issue of control is key to deciding between one and the other. Under the Fair Labor Standards Act (FLSA), a worker is assumed to be a W-2 employee and the burden is on the employer to prove this otherwise.

The Department of Labor (DOL) also explicitly states that the “economic realities” of the working relationship determine an employee’s classification and can override any agreement between the employer and the employee.

According to Maria O. Hart, an attorney specializing in employment law and business litigation, the issue of control is key to deciding between one and the other. Under the Fair Labor Standards Act (FLSA), a worker is assumed to be a W-2 employee and the burden is on the employer to prove this otherwise.

The Department of Labor (DOL) also explicitly states that the “economic realities” of the working relationship determine an employee’s classification and can override any agreement between the employer and the employee.

Hire a W-2 employee if:

● the work has to be under the employer’s supervision

● the employer has complete control over the working schedule

● the work has to be done using only employer-provided tools or software

● the work is ongoing and long-term

● the work is essential and central to your business (ie a marketing role versus a maintenance role)

Consider a 1099 contractor if:

● the work can be done remotely and requires little to no supervision

● the work can be done as and when the worker is available

● the work can be done independent of employer-provided tools or software

● the work is seasonal and completed within a defined period of time

● the worker can work for other employers simultaneously

Christy Hopkins, PHR, is a Human Resources consultant and writer at FitSmallBusinesses.com. She summarizes that there are some fields where freelancers and contractors are more common, due to their on-demand and project-based nature. They are, but not limited to:

● Graphic design

● Social media management

● Content writing or copywriting

● Accounting

● Recruiting

Then there are fields where one might struggle to find a freelancer simply because the roles are, historically, a full-time commitment that requires physical presence, using company software or tools, and has to be done under the employer’s supervision. They are, but not limited to:

● Marketing roles

● Account/client managers

● Office managers/coordinators

● Managerial/executive-level positions

So understanding your business or startup needs is absolutely imperative in allowing the employer or hiring manager to move forward effectively and efficiently.

● Graphic design

● Social media management

● Content writing or copywriting

● Accounting

● Recruiting

Then there are fields where one might struggle to find a freelancer simply because the roles are, historically, a full-time commitment that requires physical presence, using company software or tools, and has to be done under the employer’s supervision. They are, but not limited to:

● Marketing roles

● Account/client managers

● Office managers/coordinators

● Managerial/executive-level positions

So understanding your business or startup needs is absolutely imperative in allowing the employer or hiring manager to move forward effectively and efficiently.

The “true cost” of employee misclassification

Misclassifying employees hurts more than the employee and employer. It affects law-abiding businesses and American taxpayers in the forms of denied access to critical benefits and protections to which the misclassified employees should have been entitled to. Businesses that skirt the law are not paying into state unemployment insurance and workers’ compensation programs, not to mention Social Security and other taxes.

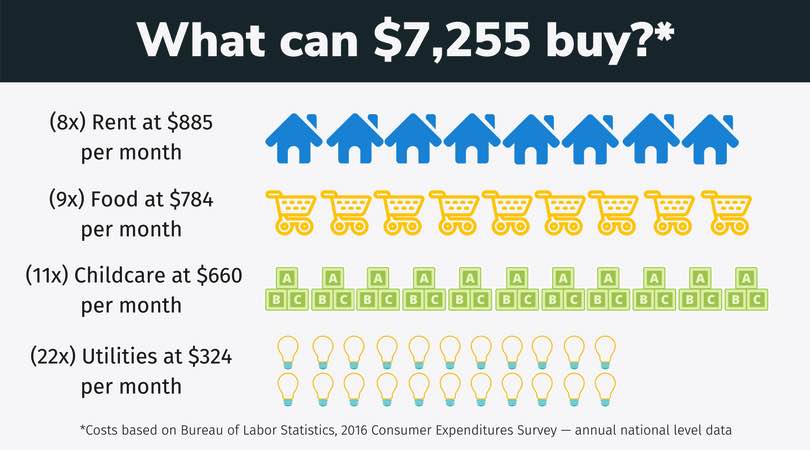

The Wage and Hour Division of the Department of Labor released in their report that employee misclassification resulted in more than $74 million in back wages for more than 102,000 workers. That’s $7,255 per employee, which can buy a lot*:

● Food for 9.25 months (at $784 per month)

● Rent for eight months (at $885 per month)

● Utilities for 22 months (at $324 per month)

● Childcare for 11 months (at $660 per month)

The Wage and Hour Division of the Department of Labor released in their report that employee misclassification resulted in more than $74 million in back wages for more than 102,000 workers. That’s $7,255 per employee, which can buy a lot*:

● Food for 9.25 months (at $784 per month)

● Rent for eight months (at $885 per month)

● Utilities for 22 months (at $324 per month)

● Childcare for 11 months (at $660 per month)

“Easy” doesn’t mean “right”

According to the National Employment Law Project, businesses save up to 30 percent of their payroll tax costs by choosing to classify employees as contractors to scale up quickly. So, at first, hiring contractors might feel like the best option when you're scaling up. At the crux of employee misclassification lawsuits is how the culprits are far from bootstrapped newbies with limited resources. Rather, they are richly valued, profitable powerhouses looking for an easy solution to cater to growing demands.

According to Hart, that’s what makes misclassification lawsuits important. “The businesses needed to scale up fast, so they hired a lot of independent contractors, probably even had their lawyers look at it, but made the wrong gamble,” she explained. “If you want to hire someone expecting all the benefits of a full-time employee but none of the liability, then you’re in danger of employee misclassification.”

In the face of a lawsuit, app-based courier service Shyp decided to reclassify all its contractors as employees in 2015, with all the bells and whistles of workers’ compensation and benefits included. Kevin Gibbon, Shyp’s CEO, made it clear to TechCrunch that the change was not the result of the lawsuit, citing the ability to train its couriers and provide more supervision as the primary benefits.

Hot on Shyp’s heels, Luxe, Eden, and Sprig quickly followed suit, though none made direct reference to employee misclassification as their motivation. At the time of this publication, three of the four mentioned businesses have gone under. While there could be a myriad of reasons as to why the businesses failed, it is fair to say the changing commitment to their workforce could have played some part.

The effects of a lawsuit linger long after defendants leave the courtroom. Uber, for example, continues to be beleaguered by public backlash from its fallout with its employees, among other things.

According to Hart, that’s what makes misclassification lawsuits important. “The businesses needed to scale up fast, so they hired a lot of independent contractors, probably even had their lawyers look at it, but made the wrong gamble,” she explained. “If you want to hire someone expecting all the benefits of a full-time employee but none of the liability, then you’re in danger of employee misclassification.”

In the face of a lawsuit, app-based courier service Shyp decided to reclassify all its contractors as employees in 2015, with all the bells and whistles of workers’ compensation and benefits included. Kevin Gibbon, Shyp’s CEO, made it clear to TechCrunch that the change was not the result of the lawsuit, citing the ability to train its couriers and provide more supervision as the primary benefits.

Hot on Shyp’s heels, Luxe, Eden, and Sprig quickly followed suit, though none made direct reference to employee misclassification as their motivation. At the time of this publication, three of the four mentioned businesses have gone under. While there could be a myriad of reasons as to why the businesses failed, it is fair to say the changing commitment to their workforce could have played some part.

The effects of a lawsuit linger long after defendants leave the courtroom. Uber, for example, continues to be beleaguered by public backlash from its fallout with its employees, among other things.

To hire when scaling up fast: it doesn’t have to be one or the other (Contractor or Employee)

Raymond Grainger, founder and CEO of Mavenlink, says a business can have a mixture of both employees and contractors. While there is no magic number or formula, he’s found having a 30 percent contractor base can work well for small businesses. The 25-year tech and IT veteran added the decision to hire full-time employees is also dependent on profit margins.“If the billable time of current full-time employees is at or above 85 percent and the profit margins are at least 50 percent, those are good indicators that the company is ready to add another full-time employee,” he says. With contractors, the profit margin may be less, so it may be better to stick with contractors and not commit a full-timer to the workload until the required margins are achieved.

He adds that a smart business owner will tap into the benefits each employment type has to offer. Having a reliable, trustworthy, solid base of contractors who can be hired as needed is a perk all fledging startups with limited resources can use. Investing in full-time employees to oversee and manage the delivery of projects, while keeping their ear to the ground for additional projects and opportunities is critical to ensuring you don’t have to do everything yourself.

Jimmy Fabiano, general manager of OnForce, a freelancer management software system, shares Grainger’s sentiment. He sees how many companies are shifting to a “blended” workforce. Fabiano observes businesses hiring full-time employees for customer-facing and technical positions to prevent the loss of intellectual property, while engaging freelancers to manage bookkeeping and databases.

It is also very possible to hire an independent contractor and switch their status to a full-time employee as their responsibilities grow. The key is to initiate the right conversation to make this happen, rather than deliberately delay the process to avoid committing to additional benefits and costs.

The point is not to pit full-time employees against independent contractors or finding the one-size-fits-all solution. When scaling up fast, both options (Contractors and employees) might be the solution when hiring. Nor should it be assumed employee misclassification is always done in bad faith. What matters is having the correct paperwork, payroll, and onboarding for each type, so when the contract or employment relationship comes to an end, it is without liability to you as the business owner or at the expense of the employee. The arrival of an on-demand economy allows both employers and employees to explore new opportunities, but for some employers, it has given way to prioritizing profits over workers’ rights.

The law is also catching up with technology. While the modern workplace has been evolving faster than Congress, the courts have been stepping up and in to fill the gaps. While the nature of business will always set the tone for the workers, compliance and the commitment to employees should remain unchanged. And in the case of employee classification, the message is crystal clear: An ounce of prevention is worth a pound of cure.

On a side note, if you're interested in hiring remote employees, we came up with a guide on how to extend your team with remote employees, I invite you to check it out. Growth Hackers is one of the top Ai marketing companies. We help them generate targeted and qualified traffic, get leads, improve conversions and increase revenue. We do so thanks to growth marketing, product development and data analysis. So, if you want your startup to gain traction, grow or even scale up, contact the Growth Hackers' team today. Hope to talk to you soon.